Mayoor School Jaipur

July 28, 2025

Why Schools Must Teach Financial Literacy to Students

By Mayoor School Jaipur - A Leading CBSE School in Jaipur

Think about this: A bright student scores 95% in 12th class. But when they get their first job, they don't understand their salary slip. They get confused about taxes and have no idea how to save money. This happens with many students across India today.

At Mayoor School Jaipur, we know that good marks are important. But we also believe students need to learn about money matters. As an experiential learning school in Jaipur, we want our students to be ready for real life, not just exams.

The Problem in India Today

Here are some shocking facts: Only 27 out of 100 adults in India understand basic money matters. For students, this number drops to just 17 out of 100. This means most young people don't know how to handle money properly. (SOURCE)

This is not just a number on paper. It affects real lives. When young people don't understand money, they make wrong choices that hurt them for years.

Why Start Teaching Money Skills Early?

Just like we teach children to brush their teeth daily, money habits are best learned when young. Children are naturally curious about money. They see parents using cards, phone payments, and cash. Instead of saying "you'll understand later," schools should use this curiosity to teach them.

For small children, we can start with simple things like knowing the difference between things they need and things they want. As they grow older, we can teach budgeting and smart spending.

What Happens When Students Don't Learn Money Skills?

Credit Card Problems: Many young adults get trapped in credit card debt because they don't understand interest rates. A small purchase becomes a big problem over time.

Fear of Investing: Without money knowledge, young people keep all their savings in bank accounts with very low interest. They miss chances to grow their money.

No Emergency Fund: Young adults often don't save money for emergencies. When something unexpected happens (like during COVID), they struggle financially.

No Retirement Planning: Saving for retirement seems too far away for a 20-year-old. But starting early makes a huge difference because of compound interest.

How Schools Can Make Money Learning Fun

Use Stories: Instead of boring lectures, tell stories. For example, compare two friends - one saves early, another starts late - to explain compound interest.

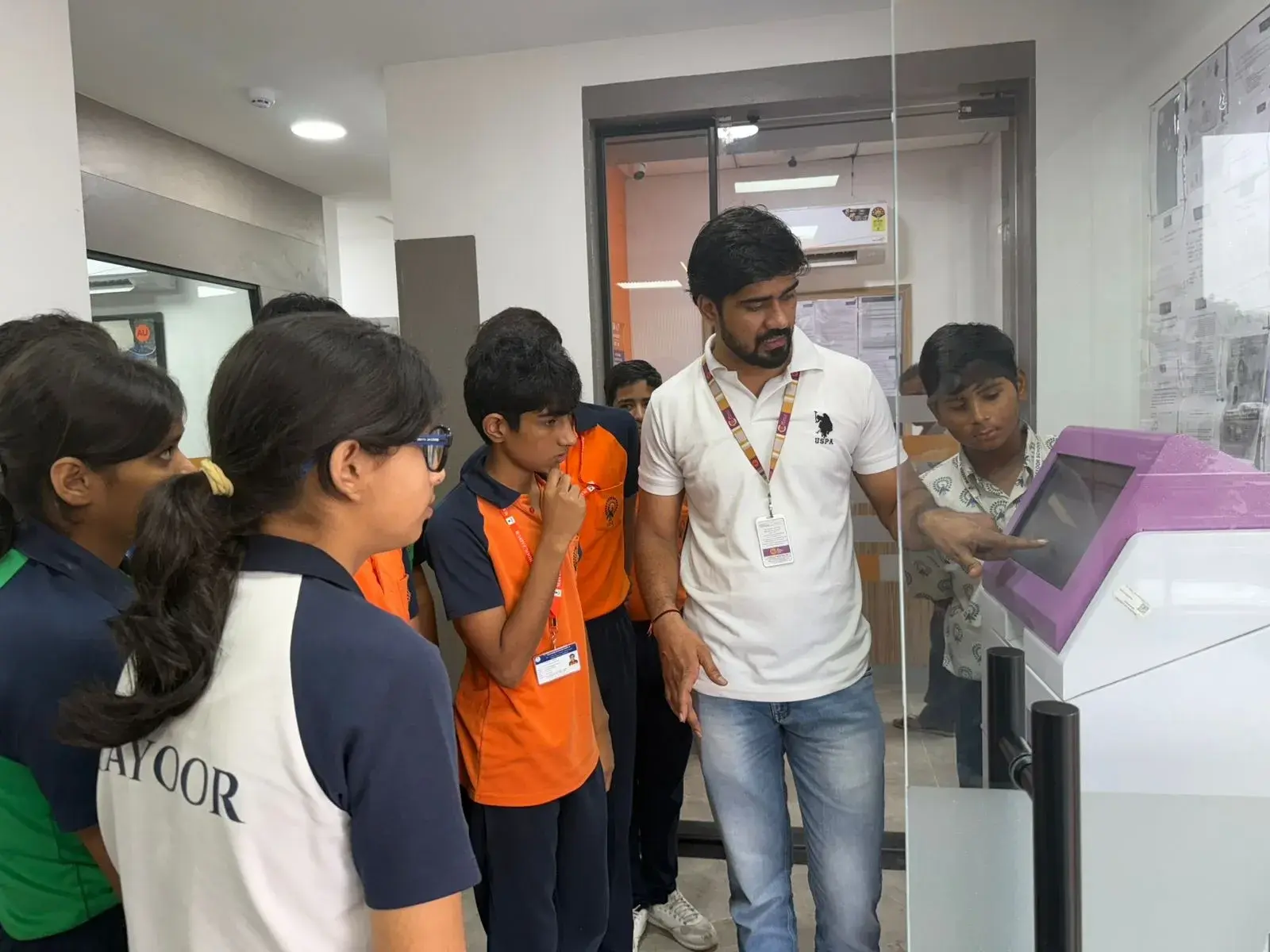

Real-Life Practice: Create classroom shops where students buy and sell things. Let them manage budgets for school events. This teaches by doing, not just reading.

Use Technology: Today's students love phones and apps. Use financial games and apps to make learning interesting.

Invite Speakers: Bring in bank employees, business owners, or parents to share real experiences. Students connect better with real stories.

Benefits Beyond Money Management

Learning about money helps students in many ways:

Better Thinking Skills: Comparing different financial options develops analytical thinking that helps in all subjects.

Math Becomes Real: Financial problems make math more meaningful and interesting.

Planning for Future: Understanding money concepts helps students set realistic goals for their future.

Confidence: Knowledge gives students confidence to make good decisions in life.

Our Role as Teachers

At Mayoor School Jaipur, we believe in preparing students for complete success in life. This means teaching life skills along with regular subjects.

The National Education Policy (NEP) 2020 also recognises the need for financial literacy in schools. As India grows economically, teaching money management skills has become very important. (SOURCE)

We don't want every student to become a finance expert. But they should graduate knowing how to manage their personal money well.

What Makes Good Financial Education?

Right for Each Age: Concepts should match what children can understand at different ages.

Practical: Focus on skills students will actually use in real life.

Indian Context: Use examples that Indian students and families can relate to.

Keep It Updated: Financial products change quickly, so education must keep up.

Why This Matters for India's Future

India has a young population that can help the country grow for many years. But this advantage will only work if our young people have the right skills, including money management.

India is expected to be the fastest-growing economy for the next decade. To really benefit from this growth, we need citizens who can make smart financial decisions and build wealth responsibly.

Our Thoughts

We must ensure they have the knowledge and skills to make these decisions wisely. Financially smart citizens don't just build personal wealth - they help build a stronger, more prosperous India. When we teach our children about money today, we're investing in India's tomorrow.

About Mayoor School Jaipur:

As a leading CBSE school in Jaipur, Mayoor School provides complete education that prepares students for real-world success. We focus on both academic excellence and life skills that help our students succeed in a changing world.